Why Bitcoin’s Layer 2 Networks Are Booming: Unpacking the Surge in Demand

Unravel the reasons behind the explosive growth of Layer 2 solutions in a post-halving world.

TL;DR:

Post Bitcoin halving, the transaction fees on the main network surged, pushing users towards Layer 2 (L2) solutions for cheaper and faster alternatives.

Layer 2 networks like Lightning Network, Stacks, Elastos, and SAVM have shown impressive performance enhancements by offering innovative features such as smart contracts and enhanced scalability, making them highly appealing in the current economic landscape.

Introduction

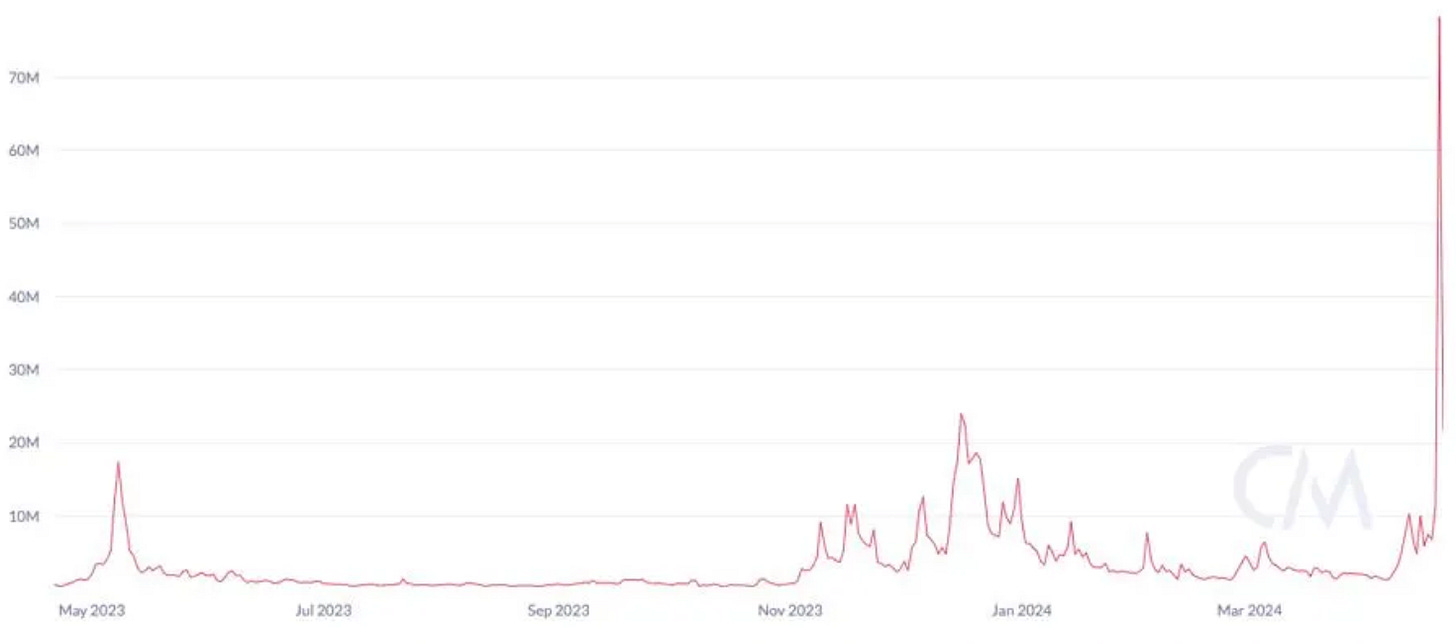

The Bitcoin halving event, which occurred on April 20, 2024, has led to an increase in trading activity and a surge in fees on the Bitcoin network. This has resulted in high fees for transactions, making it more expensive for users to transact on the mainchain. As a result, many users are seeking alternative solutions, such as Bitcoin layer 2s like the Lightning Network and side chains like Fedimint, Ark, and others. In this context, tokens associated with Bitcoin L2s, such as Elastos' ELA token, have outperformed BTC in the days since the halving. Bitcoin layer 2 solution tokens, such as STX, ELA, and SAVM, have demonstrated superior performance to BTC following the halving of the mining reward.

But, why are Bitcoin's Layer 2 solutions suddenly in such high demand? Could it be because the cost of transacting directly on Bitcoin's blockchain is soaring? Let's delve into why more and more users are flocking to Layer 2 networks like the Lightning Network and Stacks, especially after Bitcoin's latest halving event. Join, as we explore how these technologies are becoming the preferred choice for cheaper and faster transactions!

Why Bitcoin L2s are Outperforming: A closer Look Post-Halving

The Role of Bitcoin Halving

Every four years, the Bitcoin network goes through a halving event, slicing the miners' rewards in half. This April, it happened again, cutting down from 6.25 BTC to a mere 3.125 BTC. What’s the big deal, you ask? This mechanism not only keeps Bitcoin scarce and in demand but also bumps up the cost of mining, impacting transaction fees and speed on the main chain. Just when Bitcoin becomes more mainstream, it also becomes pricier to use — a real bummer, right?

Enter Layer 2 Solutions

Because no one likes waiting or overpaying, Layer 2 solutions come into play. These are not replacements but enhancements of the Bitcoin network, designed to handle excess traffic and reduce costs without compromising security. These Bitcoin Layer 2 (L2) solutions are designed to enhance the scalability and efficiency of the Bitcoin network by handling transactions off the main blockchain (Layer 1).

Types of Layer 2 Solutions

State Channels: Think of these as carpool lanes that avoid the main blockchain traffic. Only the entry and exit points are recorded on the main chain, making transactions faster and cheaper.

Sidechains: These are parallel roads, offering more lanes and thus faster speeds and lower costs. They operate alongside the main blockchain but handle transactions independently.

Spotlight on Major L2 Networks

Let's zoom in on some standout L2s that are changing the game:

Lightning Network

Famous for microtransactions, the Lightning Network ensures that small, frequent transactions don't clog up the main blockchain. It's like using a messenger app instead of mailing letters!

Stacks (STX)

Stacks extends Bitcoin's usability by introducing smart contracts and dApps directly tied to Bitcoin’s blockchain, offering more than just transactions.

Elastos (ELA)

Dubbed the "BTC Queen," Elastos provides a decentralized environment for apps and services, boosted by over 50% of Bitcoin's hash power, ensuring robust security and innovative L2 solutions.

SatoshiVM (SAVM)

Focused on supercharging transaction speed and cost, SAVM stands out as an independent L2 that doesn’t mingle with the Lightning Network or other similar solutions.

Why the Surge in L2 Adoption?

Following the Bitcoin halving event, several key factors have contributed to the performance of Layer 2 (L2) solutions, leading to their outperformance post-halving.

Increased Transaction Fees on Mainnet: Post-halving, the fees spiked — a direct hit to anyone transacting on the mainnet. L2s offer a refuge with their lower fees and faster speeds.

The reduction in mining rewards post-halving has led to an increase in transaction fees on the main Bitcoin network. This rise in fees has made transactions more expensive for users, prompting them to seek more cost-effective alternatives like Layer 2 solutions. L2 networks offer lower fees and faster transaction speeds, making them an attractive option for users looking to reduce costs and improve efficiency

Enhanced Functionalities and Smart Contracts: The ability to use smart contracts and enhanced features attract more users and developers, broadening the scope of what you can do with Bitcoin beyond just sending it back and forth.

Layer 2 solutions provide enhanced functionalities and support for smart contracts, enabling users to access a wider range of services and capabilities.

By leveraging L2 mechanisms, users can benefit from advanced features such as decentralized applications (dApps) and programmable smart contracts.

They offer scalability enhancements that address the limitations of the mainnet, attracting users seeking faster and more efficient transaction processing.

These enhanced functionalities make L2 solutions more versatile and appealing to users and developers seeking innovative solutions on the blockchain

Support for Miners Through L2 Mechanisms: With reduced block rewards, miners are making less. However, L2 solutions can offer new revenue streams through transaction fees and other incentives.

In the post-halving landscape, Layer 2 mechanisms offer support for miners facing reduced rewards.

L2 solutions can provide alternative revenue streams for miners, helping them offset the impact of halved mining rewards.

By participating in L2 networks, miners can earn rewards through transaction processing and other mechanisms, ensuring continued support for the network's security and stability

Positive Market Sentiment and Speculation: The hype isn’t just hype. Post-halving, there’s a genuine shift towards innovative, efficient transaction methods, pushing the boundaries of what Bitcoin can achieve through these L2 networks.

The Bitcoin halving event has generated positive market sentiment and speculation, driving increased interest in L2 solutions. As users and investors seek more efficient and cost-effective transaction methods, L2 solutions have gained traction as viable alternatives to the mainnet. The positive market sentiment surrounding L2 solutions has contributed to their performance post-halving, with users and investors recognizing their potential for growth and adoption in the evolving blockchain ecosystem

Security: L2 networks prioritize security measures to ensure the integrity and safety of transactions, enhancing trust and reliability in the ecosystem.

Overall, the combination of scalability, cost-effectiveness, enhanced functionality, and security features has contributed to the outperformance of these L2 networks post-halving, making them attractive options for users and investors in the evolving blockchain landscape.

A Quick Look into the L2s of Bitcoin Network:

To understand deeper on the Layer 2 (L2) networks and why they have outperformed post-halving, lets delve into the specific characteristics and strengths of each network:

Elastos (ELA):

Elastos is a decentralized operating system that offers a secure and scalable platform for decentralized applications (dApps).

The Elastos platform leverages L2 solutions to enhance scalability, speed, and cost-effectiveness of transactions on the Bitcoin network.

Elastos' focus on security, scalability, and user experience has attracted a growing user base and developer community, contributing to its outperformance post-halving.

Stacks (STX):

Stacks is a smart contract platform that enables the development of dApps and smart contracts on the Bitcoin network.

By providing unique functionalities and interoperability with Bitcoin, Stacks has positioned itself as a valuable L2 solution for enhancing the Bitcoin ecosystem.

STX's ability to offer innovative solutions and address the limitations of the mainnet has contributed to its strong performance post-halving.

SAVM:

SAVM is another L2 network that has demonstrated superior performance following the Bitcoin halving event.

SAVM's focus on faster and cheaper transactions on the Bitcoin network has resonated with users and investors, leading to increased adoption and value appreciation.

The network's ability to provide high-speed, fault-tolerant connections between servers, switches, and routers has positioned it as a competitive L2 solution in the post-halving landscape.

Final Thoughts

As Bitcoin continues to mature, the role of L2 solutions becomes increasingly vital. They not only provide relief from rising fees and slower speeds but also introduce groundbreaking functionalities that enhance Bitcoin’s utility. With each halving, as challenges in scalability and cost arise, L2 solutions step up, proving their worth and driving adoption. The surge in L2 performance post-halving isn't just a temporary trend but a glimpse into the future of Bitcoin’s evolving ecosystem.

So next time you’re grumbling about high fees or slow confirmations, remember, there’s an L2 solution likely tailored just for your needs!